tax avoidance vs tax evasion hmrc

Summary conviction for evaded income tax carries a six-month prison sentence and a fine up to 5000. Tax evasion is ILLEGAL.

Received A Letter From Hmrc Saying You Might Be Involved In Tax Avoidance And Don T Know What It Means In This Article We Help You Understand It Low Incomes Tax Reform

Contact the HMRC fraud hotline if you cannot use the online service.

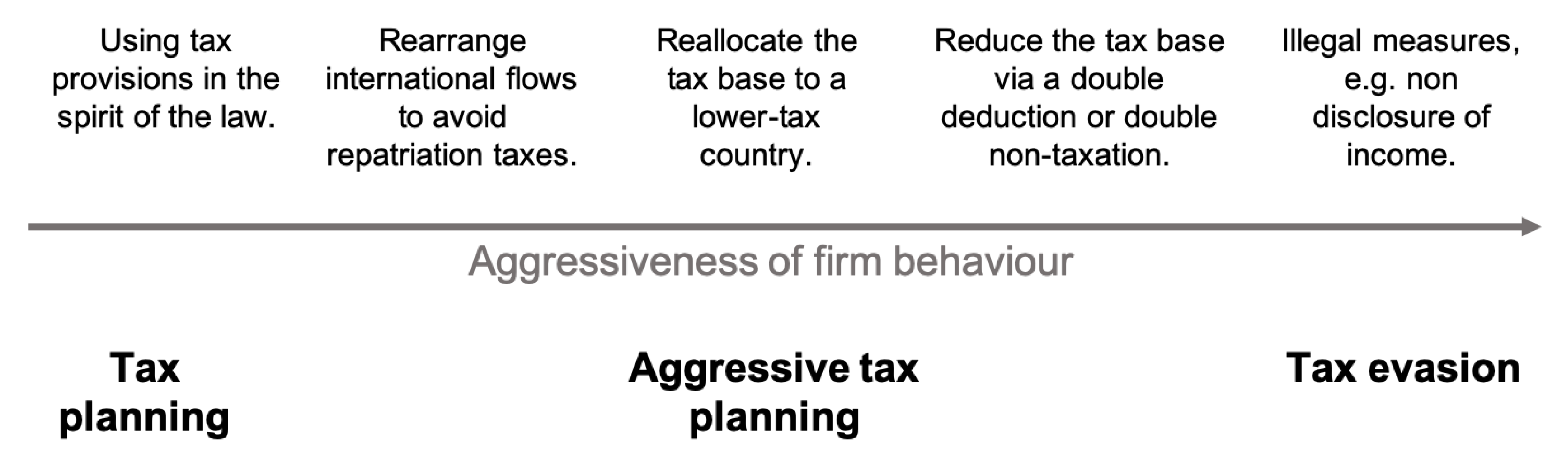

. When tax avoidance strays into. Basically tax avoidance is legal while tax evasion is not. Tax evasion is the deliberate non-payment of taxes that is illegal.

The topic of tax evasion vs tax avoidance is popular amongst both tax payers and accountants but what is the difference between the two. Tax avoidance may exist in a controversial area of the tax system but tax evasion most definitely doesnt. 44 203 080 0871.

How serious is tax evasion UK. How many years can HMRC go back for unpaid tax. Tax evasion means concealing income or information from the HMRC and its illegal.

Understanding how tax evasion and tax avoidance compare is key to avoiding landing yourself in hot water or worse committing a criminal offence. DAC6 is a European regulation. Tax avoidance means exploiting the system to find ways to reduce how much tax you owe.

Tax planning either reduces it or does not increase your tax. 465 61 votes. Schemes it is likely that HMRC will uncover companies whove claimed what they shouldnt.

Monday to Friday 9am to 5pm. In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex. Crossing that line can.

Avoiding tax is legal but it is easy for the former to become the latter. The tax evasion vs tax avoidance debate is a long-standing one. The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts.

Tax evasionThe failure to pay or a deliberate underpayment of taxes. Can you go to jail for tax avoidance. Its as simple as that.

Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income. It is the illegal. Tax evasion is illegal and considered fraud which involves breaking the law for example deliberately hiding the trading revenue or using tax avoidance.

Discover more about tax avoidance and evasion. The difference between tax avoidance and tax evasion essentially comes down to legality. Other ways to report.

In its most simplistic form there are plenty of people whose financial. Penalty for Tax Evasion in California Tax evasion in California is punishable by up to one year in county jail or state prison as well as fines of up to. If they suspect deliberate tax evasion they can investigate.

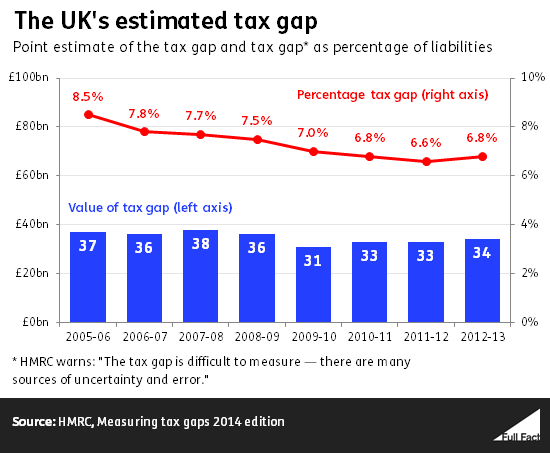

From 2018 to 2019 HMRC secured a record 341 billion in additional tax through activity tackling tax avoidance evasion and non-compliance. However the simple difference between. HMRC defines Tax Evasion as Concealing of taxable income or the use of benefits to avoid the tax.

With recent gov. Whether its famous musicians footballers or global businesses in recent years HMRC have made it a priority to clamp. HMRC will investigate further back the more serious they think a case could be.

More serious cases of income tax evasion can result. Well one massive difference is that tax evasion is illegal while tax avoidance is legal well to a certain extent anyway. The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk.

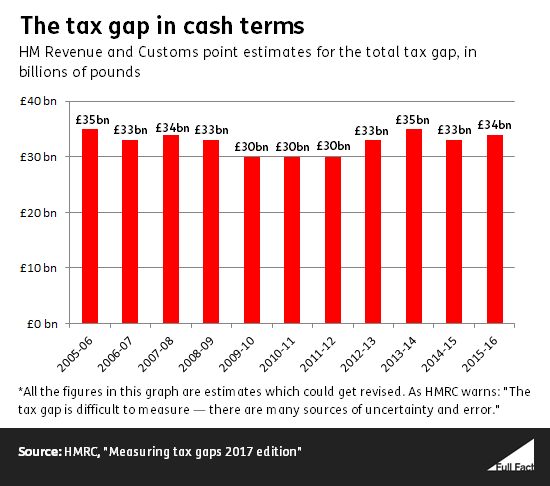

Tax Evasion And Avoidance How Much Can Be Raised Full Fact

Changing Tax Avoidance Attitudes Hmrc Research Tax Evasion

Hmrc Targets Thousands Over Tax Evasion Schemes Grunberg Co

Tax Avoidance Tax Evasion The Way To Minimise Taxes

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Tax Evasion Hmrc New Investigation Powers

Persona Finance Ltd On Twitter Check Out 𝗣𝗲𝗿𝘀𝗼𝗻𝗮 𝗙𝗶𝗻𝗮𝗻𝗰𝗲 Blog Tax Avoidance Vs Tax Evasion Https T Co Vsf6hswqbq Accountant Accountants Accounting Accountingservices Business Finance Personafinance Tax Taxation

Hmrc Launches Ad Campaign Aimed At Tax Evaders Tax Avoidance The Guardian

Diageo New Tax Schemes Exposed Movendi International

Tax Evasion How To Get To The Top

Tax Dodging How Big Is The Problem Full Fact

Hmrc Names Another Tax Avoidance Scheme Contractor Business Weekly

Impact Of Tax Avoidance And Evasion Divorce Financial Proceedings

Are Tax Avoidance Systems Authentic By Dave Marcussen Issuu

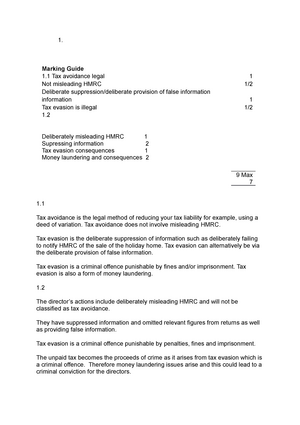

Acfi212 May Exam Answers 1 Marking Guide 1 Tax Avoidance Legal 1 Not Misleading Hmrc 1 Studocu

What I Learned About Hmrc When I Posed As A Tax Avoider Greg Wise The Guardian

What S The Difference Between Tax Avoidance And Evasion Is Tax Avoidance Legal And How Do The Schemes Work The Sun